So Why Did I Come to India to Research Microfinance?

So Why Did I Come to India to Research Microfinance?

- Posted by Colleen

- On October 9, 2022

- Comments

- 3

So far I’ve focused this blog on the cultural exchange component of my India experience, but there’s also a professional component to each Fulbright grant. Some professors focus on teaching, others on research, and some focus on both.

In my case, I’m a research scholar, and my Fulbright project is investigating the impact of microfinance for women.

Why would a social work professor care about microfinance?

In a nutshell: because I care about poverty.

I’m interested in ways to help women (especially mothers) living in extreme poverty pull themselves out of what are often dire circumstances to improve health, wellbeing, and future opportunities for themselves and their children. (Note: “extreme poverty” means an income of less than $1.90 US per day)

Many women living in extreme poverty already possess some income-generating skills with which they could improve their economic condition.

Consider the rural mother who is experienced in animal husbandry and knows that if she could afford to add one buffalo to her few goats she would have enough milk to both feed her family and gain daily income by selling fresh milk in the local market.

An urban woman living in a slum is a talented seamstress and embroiderer and regularly makes her family’s clothes, but with purchase of raw materials she could begin taking orders for the sought-after adorned saris worn for weddings and other special occasions.

The problem typically isn’t that these women lack talent or drive; the problem is that they lack fair access to the financial resources that would help them get ahead.

For example, banks won’t loan to the poorest people because they have neither reliable income nor assets to leverage as collateral.

But women also face added barriers to pulling themselves out of poverty, such as low literacy and numeracy skills (since families tend to send boys to school over girls), poorer health (since traditional cultural norms can dictate that men and boys eat first and women and girls eat whatever is left), and inconsistent work as informal laborers in positions such as street hawkers or waste pickers.

Microfinance seems to be one potential way to help these women (and to address poverty more broadly).

Essentially, microfinance is a package of economic resources that the world’s most impoverished people are excluded from, including:

- Micro-Loans – loans as small as Rs. 10,000 (about $125 US) can help a woman start a micro-enterprise or to obtain assets that will help them find/keep work (e.g., scooter)

- Savings – women being able to safely put away small amounts of money (sometimes as little as Rs. 200; roughly $2.50 US) where it can’t be taken by extended family members can make the difference between her daughter attending school or not

- Insurance – to protect against economic shocks that would push the family further into poverty such as a husband’s death or destruction of their home by monsoon floods

You can hear a few stories of how microfinance can impact the lives of women and their families (and see some cool footage from India) in this short 4-minute video below.

So why do this research in India?

The idea of microfinance first came about in Bangladesh, but since India has the most people in extreme poverty of any country in the world, microfinance has been used here pretty extensively. And because of the extensive use here, there’s been a lot of experimentation in terms of how to organize the women’s groups, ways to govern the groups, and even different funding approaches that are unique to India (such as Corporate Social Responsibility [CSR] programs, where for-profit corporations are required by law to give a portion of their profits to socially uplifting organizations each year).

In this project, I wanted to first learn about microfinance from the experts on the ground – women in microfinance self-help groups and the staff of organizations that support those groups – to inform my study. And for that, there really was no better place than India.

So what’s the goal of my research?

First, I interview women from different microfinance self-help groups (SHGs) to learn about their experiences and how their lives have changed (or not) while in the program. Then, based on what I learn from those interviews, I’ll create a new data collection tool that can be used by researchers and practitioners in the future.

The ultimate goal is to better understand how microfinance impacts women in extreme poverty – and not just economically, but in other parts of their lives, too (emotional, familial, social, legal, and political).

I hope this wordier-than-usual post has given you an idea of what I’m doing here in Pune – and why I think it’s important.

Until next time!

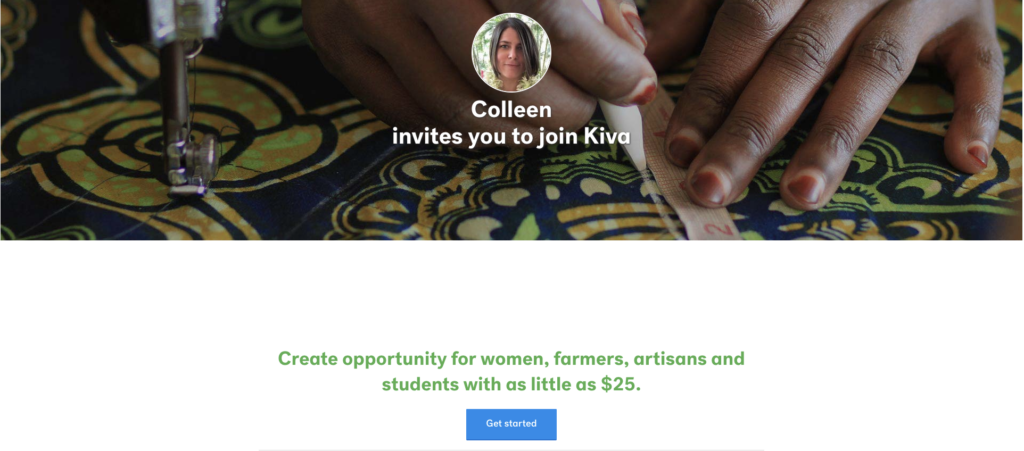

Feeling inspired to help?

In case anything in this post has inspired you to help women in developing countries to pull themselves out of poverty AND you have $25 to fund a micro-loan, please check out KIVA.org using my personal link here. That $25 is not a donation, it’s a loan – so once your $25 is repaid by the borrower you choose, you can either take your money back or find another aspiring entrepreneur to help.

I’ve been making micro-loans through KIVA since 2014, so I can wholeheartedly recommend this organization! So far, I’ve loaned to 56 women in 29 different countries. A small act, for sure, but one I’m proud to continue to contribute toward.

If you have a question or comment about KIVA (or micro-loans in general), let me know by adding a comment below!

2 Comments